For many people in the UK, “Credit Builder” cards feel like a punishment. They often come with high fees, ugly designs, and absolutely no rewards. You are essentially paying for the privilege of fixing your past mistakes.

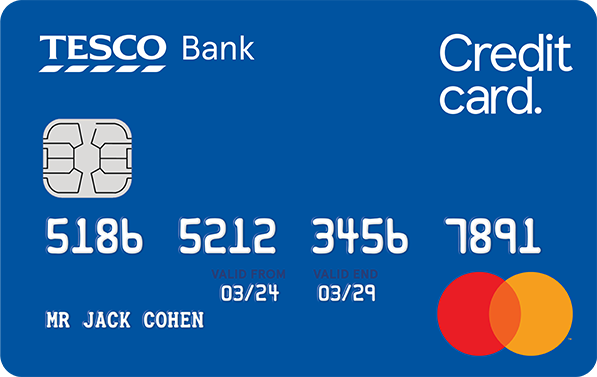

The Tesco Bank Foundation Credit Card breaks this mould.

It is one of the few cards in the sub-prime market that treats you like a standard customer. Not only does it help you repair your credit rating with manageable limits and tracking tools, but it also rewards you with Tesco Clubcard points on almost every transaction.

If you are tired of “vanilla” credit builder cards that give nothing back, the Foundation card is a refreshing alternative. In this review, we will analyse whether the lower APR (compared to competitors) and the Clubcard perks make this the best choice for your financial recovery journey.

You will remain on the current site.

The Core Mission: Building a Solid Foundation

As the name suggests, this card is designed to lay the groundwork for a better financial future. It is specifically targeted at those with a poor credit history, no credit history, or those who have simply been rejected by high-street lenders.

Smart Starting Limits

Tesco Bank takes a responsible approach. New customers are offered a starting credit limit between £200 and £1,500.

- Why this works: It is enough to cover weekly groceries or fuel, but not enough to get you into deep trouble.

- The Growth Path: If you manage your account well—staying within your limit and paying on time—Tesco monitors your progress. You may be considered for regular credit limit increases, which is a key factor in improving your credit score over time.

Tesco Bank CreditView

One of the standout features is the integrated tech. Cardholders get free access to Tesco Bank CreditView (provided by TransUnion) for 3 years.

- This isn’t just a static number. It updates monthly, allowing you to see exactly how your good behaviour with the card is pushing your score upwards. It turns credit repair into a measurable, gamified process.

The “Secret Sauce”: Earning Clubcard Points

This is where Tesco beats rivals like Vanquis or Aqua. Most credit builder cards offer zero rewards.

With the Foundation Card, you earn Clubcard points almost everywhere you shop:

- In Tesco: Collect 1 point for every £4 spent (on top of your usual Clubcard points).

- Tesco Fuel: Collect 1 point for every £4 spent on fuel (plus 1 point for every 2 litres).

- Everywhere Else: Collect 1 point for every £8 spent outside of Tesco.

While the earn rate is lower than premium Tesco cards, the fact that you can earn rewards at all on a bad credit card is exceptional. It means your weekly shop can help pay for a family day out or money off your bill, even while you are fixing your finances.

The Cost: Competitive APR

When you have bad credit, you expect to pay sky-high interest. Competitors often charge 34.9% or even 39.9% APR.

The Tesco Foundation Card is currently competitive, with a Representative APR of 29.9% (Variable).

- While still high compared to a “prime” card, it is significantly cheaper than many alternatives in the credit builder space.

- Warning: As with all cards in this category, the goal is to pay the balance in full every month. If you do, the interest rate becomes irrelevant.

Eligibility: Can You Apply?

Tesco has clear criteria. To be considered, you generally need to meet the following:

- Income: You must have a minimum annual income of £5,000.

- Residency: You must be a UK resident aged 18 or over.

- History: You cannot have been declared bankrupt in the last 12 months.

- Exclusivity: You cannot currently hold another Tesco Bank credit card.

Unlike some lenders who accept anyone, Tesco balances accessibility with responsibility. They want to see that you have some income to support your repayments.

Pros and Cons: The Quick Verdict

Pros (The Wins)

- Clubcard Points: The only major credit builder card with a supermarket rewards scheme.

- Lower APR: At 29.9% Rep. APR, it is cheaper than Vanquis (approx 29.5-39.9%) or Aqua (34.9%).

- CreditView: Free access to your TransUnion score for 3 years is a valuable educational tool.

- Trusted Brand: Dealing with a household name offers peace of mind compared to lesser-known sub-prime lenders.

Cons (The Warnings)

- Income Requirement: The £5,000 minimum income barrier excludes some potential applicants (e.g., homemakers with no personal income).

- Low Limits: Starting at £200 might feel restrictive for some users.

- Strict Criteria: Recent bankruptcy (last 12 months) is an automatic “no”.

Final Thoughts: The “Useful” Credit Builder

The Tesco Bank Foundation Credit Card is arguably the best “all-rounder” for credit repair in the UK.

It doesn’t just sit in your wallet as a tool for debt; it works for you. By turning your necessary spending (groceries and petrol) into points, it adds value to your life immediately. If you shop at Tesco regularly and need to polish your credit score, this card is the logical choice.

It offers a path back to mainstream credit without making you feel like a second-class customer.

You will remain on the current site.