So, have you heard how a credit card can benefit your daily life? If you’re not really understanding of how a credit card works, let us explain. Then it’s going to work. Simply, you can get a card and use it to pay things. It is like a personal wallet that is way more organized.

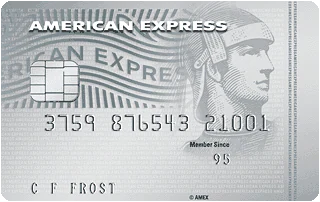

The thing is, there are credit cards that like to put extra benefits to make people happier, which is why this card is such a good thing since it has so many extra benefits. Down below, we’re going to tell you everything about the American Express Platinum Cashback Everyday Card.

So if you truly are interested in learning about the card and all the amazing cash back that we’ve mentioned above and amazing other benefits like travel benefits, we are here. You just need to keep reading down below.

Why we recommend the American Express Platinum Cashback Everyday Card

It’s time to recommend the credit card. So why do we recommend it? Well, we truly recommend it because the amount of amazing benefits that you have, more specifically the cash back ones you see when you first get the credit card, you’ll get a welcoming bonus.

In that bonus, for the first three months of having the card, you’ll be able to get 5% cash back on purchases that are up to $100. Not only that, but after that is over, you’ll be able to get 0.5% cash back and 1% cash back on purchases up to 10 thousand dollars and above that value.

What can I use the credit card for?

You can have many users with the card. One of the main ones is going to be traveling. If you travel a lot, this is the card for you. You see, with this credit card, you are going to be able to get access to global assistance and also travel accident insurance.

That way you won’t need to pay anything extra even more, but the card is international, which means that you won’t have to worry anything about having to change cards when travelling. As you can see, travels are going to be really good with this one.

Credit card advantages

So many benefits. You must be really aware of how good this credit card is. We actually have not really seen so many benefits in a card in a really long time. So if you really are interested in learning all of them, let’s take a look.

- Get 5% cashback on your purchases (up to £100) for the first three months of Card membership. 18+, subject to status

- After your welcome bonus period (first three months), you’ll earn up to 1% cashback, depending on how much you spend on the Card within your Card membership year

- Receive 0.5% cashback on spend up to £10,000

- Receive 1% cashback on spend above £10,000

- paying off your balance in full or over several months

- No additional application or extra credit checks required

- A fixed monthly fee is shown upfront, with no interest charged on your installment plan balance

- American Express Offers

- Global Assist

- Travel Accident Insurance

- Purchase and Refund Protection

- Earn rewards on the purchases the way you usually do

Credit card disadvantages

And just like you were going to have some benefits, that disadvantages cannot be forgotten. Down below, we brought you a list of all the disadvantages that we could find. So let’s see.

- High APR

How is credit analysis carried out in the American Express Platinum Cashback Everyday Card

Are you looking for the credit analysis? If you don’t really understand how the credit analysis works or what it is, don’t worry, we’re here to explain for the new ones. The credit analysis is an analysis made to your credit score. That is going to define if you get or not the card along with some fees.

The cretinous This is a type of credit history, like every financial decision you’ve made from credit cards, purchases and things like that. The company will then analyze all of that. To be able to get access to that information, they will need some specific documents.

And those documents are going to be found in the application process. You’ll send them yourself to the company after applying for the card, and then they’ll be able to take a look. After some time they did analyzation and see if you should get the card or not.

Is there a maximum and minimum credit card limit?

Well, if there is a maximum and a minimum, we couldn’t find it, but we are pretty sure that there is none of that. The credit card there is very common to not have any information about the credit limits before you actually apply for it. Even more, it is very common for it to be totally dependable on your credit score.

That is why we are not really that worried about the card and what the limit will be because we know that one way or another you are going to find more about it and are going to find if this is the card for you. And of course along with the limit.

Do you want to request? Learn how to get the American Express Platinum Cashback Everyday Card?

There are so many things that you can do to apply for the card and make it way easier than you usually would have. One of those things, of course, is going to read this article and analyze all the information that it has.

The other reason is going to be for you to click on below, because if you do, you’re going to be able to find the second part of the article. There, we are going to explain everything that you need to know in order to apply for it.