Applying for the Tesco Bank Foundation Credit Card is a smart step towards financial recovery. Unlike many “sub-prime” lenders who operate in the shadows, Tesco Bank offers a mainstream banking experience with a clear path to better credit.

However, just because it is a “Foundation” card designed for those with lower scores, it does not mean approval is automatic. Tesco Bank has specific criteria regarding income and past financial conduct.

In this guide, we will navigate the application process together. We will outline the specific “Hard Rules” you must meet to avoid immediate rejection, how to use the Eligibility Checker to protect your credit file, and how to link your Clubcard during the application to ensure you start earning points from your very first transaction.

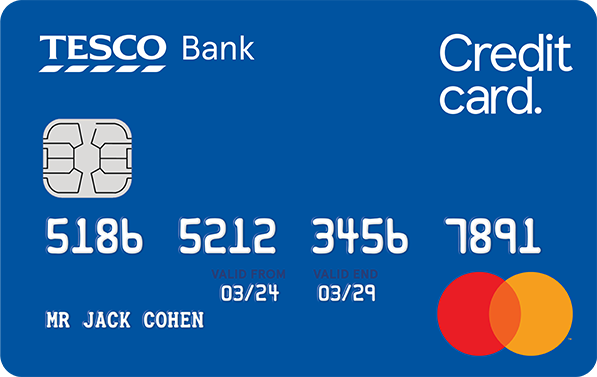

Tesco Bank Foundation Credit Card

-

Acceptance:

Poor Credit OK

-

Description:

29.9% Rep. Variable

-

Rewards:

Clubcard Points

-

SafeCheck: Check your eligibility in 60 seconds with a “soft search” that does not impact your credit score.

-

Credit Building: Designed specifically for people with limited credit history or past financial bumps.

-

Aqua Coach: Includes free access to your credit score and personalised tips inside the app.

-

Limit Increases: Potential for a credit limit increase every 4 months if you manage your account well.

-

Cost: No annual fee to hold the card.

-

The Safe Start: Ideal for anyone nervous about applying for credit; the eligibility checker removes the guesswork.

-

Educational: The Aqua Coach feature is a standout, teaching you how to improve your score rather than just giving you a card.

-

Strict Rules: While it accepts bad credit, you generally cannot have had a CCJ in the last 12 months.

-

Pay In Full: With a Representative APR of roughly 34.9% (variable), carrying a balance is expensive—set a Direct Debit to clear it monthly.

Phase 1: The “Hard Rules” (Do You Qualify?)

Before you spend time filling out forms, you need to verify that you meet the baseline criteria. Tesco Bank is transparent about who this card is for, but also who it is not for.

You are likely to be approved if:

- You want to build or rebuild your credit history.

- You have a regular income.

You will be DECLINED if you do not meet these baselines:

- Income: You must have a minimum annual income of £5,000. This is lower than many banks, but it screens out those with absolutely no means to pay.

- Residency: You must be a UK resident aged 18 or over.

- Bankruptcy: You must not have been declared bankrupt in the past 12 months nor have any ongoing bankruptcy proceedings.

- Existing Customer: You cannot hold another Tesco Bank credit card currently. If you do, you must close it and wait before applying for this one.

Phase 2: The Eligibility Checker (Soft Search)

If you are nervous about your credit score, do not apply for the card directly. Use the Foundation Eligibility Checker first.

Why is this step crucial?

- No Footprint: It performs a “Soft Search” on your credit file. You can see it, but lenders (like mortgage providers or car finance companies) cannot.

- Risk-Free: It gives you an indication of whether you will be accepted.

- Confidence: If the checker says “Likely to be approved,” you can proceed with the full application knowing your chances are excellent.

Phase 3: Preparing Your Documentation

The application is digital and efficient. To ensure you don’t get timed out, have these details ready:

- Address History: Your residential addresses for the last 3 years.

- Tip: Ensure you are registered on the Electoral Roll at your current address; this significantly boosts your chances with Tesco.

- Income Details: Your annual income figure (before tax).

- Bank Details: Your Sort Code and Account Number (for Direct Debit setup).

- Clubcard Number: Have your Tesco Clubcard handy. You will be asked for the number so they can link the accounts. If you don’t have one, they will create one for you.

Phase 4: The Step-by-Step Application Process

Once you pass the eligibility check, here is the workflow:

1. About You Enter your name, date of birth, and contact details.

2. Financials & Employment You will input your employment status and income.

- Tesco Bank uses this to calculate your Credit Limit. Depending on your affordability, you will be offered a limit between £200 and £1,500.

- Note: You cannot request a specific limit; the system assigns it based on risk.

3. Clubcard Link Enter your Clubcard number here. This ensures that when you spend on the credit card, the points go to your main Clubcard account automatically.

4. The “Hard” Search When you submit the final application, a full credit search is performed. This will leave a footprint on your file.

5. The Decision

- Instant: Most decisions are immediate. You will see your credit limit and your APR (typically 29.9% variable).

- Referred: Sometimes, they need to verify your ID manually. You may receive a letter or email asking for documents.

Phase 5: Post-Approval Setup

Card Delivery: Your card usually arrives within 5 to 7 working days.

Register for Tesco Bank CreditView: This is a key benefit. Once your account is open, register for CreditView.

- It gives you free access to your credit report (provided by TransUnion) for 3 years.

- Log in monthly to check your progress. Seeing your score go up is the best motivation.

Link to App: Download the Tesco Bank Mobile Banking App. It allows you to freeze your card, view your PIN, and manage payments on the go.

Phase 6: Strategic Management Rules

To turn this card into a credit-building machine, follow these golden rules:

Rule #1: The Direct Debit Set up a Direct Debit for the Full Balance.

- The 29.9% APR is competitive for bad credit, but it is still high. If you pay in full, you pay zero interest.

- If you cannot pay in full, always pay at least the minimum to avoid late fees and negative marks.

Rule #2: The “Weekly Shop” Strategy Use the card only for your weekly Tesco shop.

- Benefit 1: You earn extra Clubcard points.

- Benefit 2: You keep your utilization low (buying food is a predictable expense).

- Benefit 3: You have the money in your bank account already, so you can pay it off immediately.

Rule #3: Wait for the Increase Tesco Bank monitors accounts for credit limit increases.

- Do not ask for one immediately.

- Use the card sensibly for 4-6 months. Often, they will contact you to offer a higher limit. Accepting this (but not spending it) boosts your score further.

Ready to Rebuild with Rewards?

The Tesco Bank Foundation Credit Card is a rare find: a tool that helps you fix your past while rewarding your present. If you meet the income criteria, it offers a safe, trusted, and rewarding path back to financial health.

You will be redirected.