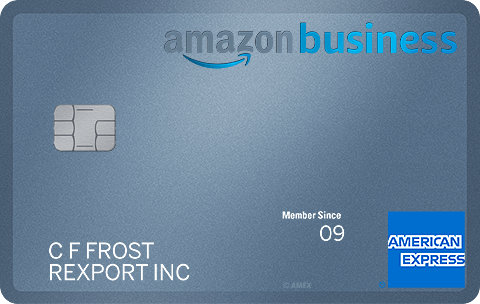

Amazon Business American Express

-

Annual Fee:£50 (£0 in your first year)

-

Representative APR39.7% APR variable

-

Credit LimitAssumed credit limit of £1,200

-

Purchase Rate28.3% p.a. variable

Am I Eligible?

-

The business has a current UK Bank or Building Society account

-

You are aged 18 or over

-

You have a permanent UK home address

-

You will pay the annual fee of £50, after your first year of Cardmembership.

-

You have an Amazon Consumer Prime, Consumer or Business subscription.

In the business world, especially in the UK, every financial detail can make the difference between growth and stagnation. Companies of all sizes seek ways to optimize cash flow, simplify expense management, and, whenever possible, derive additional benefits from day-to-day spending.

This is precisely the context in which the Amazon Business American Express credit card fits in. A partnership between two trusted global brands, Amazon and American Express, the card combines credibility, flexibility, and rewards geared toward the business environment. For those who regularly shop at Amazon Business or are looking for an efficient tool to organize their corporate finances, it could be a strategic option.

Interested? See who’s eligible for the Amazon Business credit card.

The Amazon Business American Express card isn’t aimed at ordinary consumers. Its target audience is registered businesses and independent professionals who require a credit solution tailored to their corporate needs.

- Small, medium or large companies based in the UK.

- Self-employed professionals or sole proprietors who use Amazon Business as part of their purchasing routine.

- Businesses that want to extend payment terms or take advantage of financial rewards in the form of cashback.

- Organizations that value clear expense reporting and integration with financial management tools.

The card is also attractive to managers looking to clearly separate corporate and personal expenses, creating greater transparency in accounting and greater efficiency in cost control.

Have this handy: Documents to apply for the Amazon Business Credit Card

As with any financial product, applying for a card requires careful analysis and basic documentation. Having all the necessary paperwork ready before starting the process increases your chances of approval and speeds up the process.

- Identification documents of the company’s legal representative, such as a valid passport or driver’s license.

- Proof of address for the company and the person responsible, through recent utility bills or bank statements.

- Company information, including registration number and tax address.

- Basic financial data, such as annual revenue volume and nature of operations.

- Bank details required to set up automatic payments via direct debit.

With these documents, American Express will be able to assess eligibility and offer a credit limit appropriate to the company’s profile.

How the Amazon Business credit card can be useful in your everyday life

More than just a payment method, Amazon Business American Express works as a management tool that can transform a business’s day-to-day financial operations.

It helps simplify the purchasing process, especially for businesses that already rely on Amazon Business to purchase supplies, office equipment, or technology. Each transaction made with the card accrues benefits that return in the form of cashback or extended payment terms, providing financial flexibility.

Security is another important factor. When shopping online, especially on digital platforms, it’s essential to have fraud protection and efficient support in case of problems. The card offers this confidence, backed by American Express’s reputation.

Another benefit is clear reporting. All transactions are recorded in detailed digital statements, allowing managers or accountants to track expenses in real time. This transparency helps not only with planning but also with preparing for audits or tax returns.

Before you order yours: our tip for new customers

While the card offers clear advantages, it’s important to adopt a strategy from the outset. The main recommendation for new customers is to plan their card use, aligning it with the company’s real needs.

- Use your card primarily for recurring, predictable expenses, such as office supplies, gas, or digital payments.

- Take advantage of the option to choose between cashback or extended payment terms, but make this choice based on your current financial situation.

- Set up direct debit to ensure at least the minimum payment is made on time, avoiding high interest rates and preserving your company’s credit history.

- Keep card usage separate from personal expenses to maximize accounting transparency and avoid tax confusion.

By following these guidelines, the card ceases to be just a credit resource and becomes a strategic ally for sustainable business growth.

Amazon Business Credit Card: Is it worth it or not? See our review

The answer to this question depends on your company’s profile. For organizations that make frequent purchases on Amazon Business, the benefits are clear: direct cashback, full integration with the platform, and simplified reporting. Furthermore, the ability to choose extended payment terms can significantly boost cash flow.

For businesses that don’t use Amazon much, the benefits still exist, but they may not be as significant. While the card offers rewards across general spending categories, most of the benefits are concentrated on purchases made within the Amazon ecosystem.

Another factor to consider is acceptance. While American Express is widely recognized, some establishments in the UK still don’t accept it. Therefore, you may need to keep a second credit card as an alternative.

Overall, our analysis shows that Amazon Business American Express is especially beneficial for businesses that shop regularly on Amazon, seek clear expense reporting, and want to balance financial benefits with convenience.

Apply for your Amazon Business credit card now safely and quickly

The Amazon Business American Express application process is simple and straightforward. Just have the basic information on hand and follow the steps outlined on the official website.

- Go to the Amazon Business UK website and choose the American Express card option.

- Fill out the online form with information about the company and the legal representative.

- Please provide identification documents and proof of address.

- Provide the banking and financial information required for the analysis.

- Please wait for a response from American Express regarding approval.

- If approved, receive the card in the mail and activate it.

- Once activated, the card will be ready to use.

In the next section, we’ll explain in detail how each step of the application process works, as well as provide helpful guidance to increase your chances of approval.